HMRC Personal Income Tax

Personal Income Tax Rates

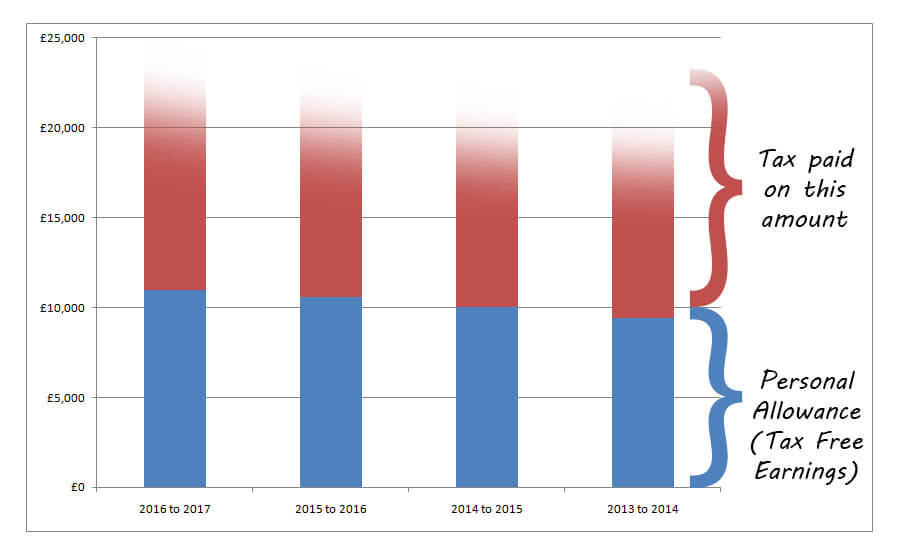

The Income Tax Personal Allowance is an amount of money you are allowed to earn per year without paying tax. Tax is paid on any amount over this Personal Allowance.

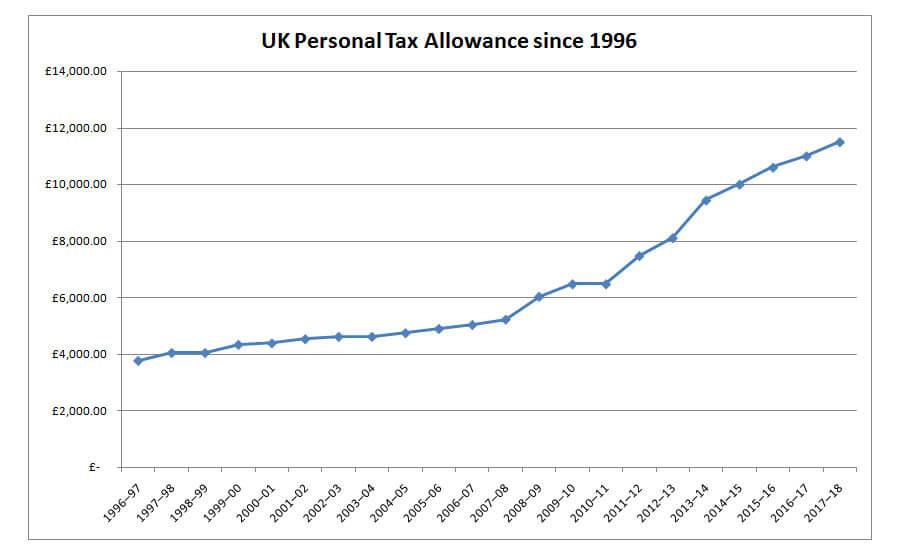

Tax Allowance figures for the past 20 years

The Personal Tax Allowance has been gradually increasing over the past 20 years, meaning that those on low incomes pay less tax on their earnings.

Personal Tax Allowances

The table below shows Personal Allowance figures since the 2014/15 tax year.

| Allowances | 2016/2017 | 2015/16 | 2014/15 |

| Personal Allowance | £11,000 | £10,600 | £10,000 |

The maximum amount you can earn to receive the full Personal Allowance is £100,000. For every £2 earned above this limit the Personal Allowance figure is decreased by £1.

Tax Rates and Bands

Tax is paid based on any income received above the Personal Allowance. The amount of tax is broken down into different bands with higher rates being charged for people with higher incomes.

| Band | Rate | Income 2016/17 |

Income 2015/16 |

Income 2014/15 |

| Personal Allowance | 0% | £11,000 | £10,600 | £10,000 |

| Basic rate | 20% | £11,000 – £43,000 | £10,600 – £42,385 | £10,000 – £41,865 |

| Higher rate | 40% | £43,000 – £150,000 | £42,385 – £150,000 | £41,865 – £150,000 |

| Additional rate | 45% | Over £150,000 | Over £150,000 | Over £150,000 |

Dividends Tax Rates and Bands

Dividends are payments made to shareholders of Limited Companies as a share of the company’s profit.

The amount of tax payable on dividend income depends on all other taxable income in a tax year, although the first £5,000 of dividend in a tax year is tax-free.

Dividends are treated as the top slice of income.

| Band | Rate | Income 2016/17 |

| Dividend Allowance | 0% | £5,000 |

| Basic rate | 7.5% | Up to £43,000 |

| Higher rate | 32.5% | £43,000 – £150,000 |

| Additional rate | 38.1% | Over £150,000 |

Personal Savings Allowance

From 6th April 2016, if you are a taxpayer at basic rate level you will be eligible to earn up to £1,000 in savings income tax-free. Whilst individuals are a taxpayer at a higher rate will be eligible to earn up to £500. This means that most people will not have to pay tax on savings interest and that banks will stop charging tax to your account interest.

The amount of your Personal Savings Allowance depends on your income.

| Tax Rate | Income Band | Personal Savings Allowance |

| Under £17,000 | You won’t pay tax on any savings income | |

| Basic 20% | Up to £43,000 | Up to £1,000 in savings income is tax-free |

| Higher 40% | £43,001 – £150,000 | Up to £500 in savings income is tax-free |

| Additional 45% | Over £150,000 | No Personal Savings Allowance |

To claim Personal Savings Allowance you do not need to do anything. For basic rate taxpayers, if you obtain savings income/interest that is over £1,000 (£500 for higher rate taxpayers), you’ll need to pay some tax on this. HMRC usually collect your tax by changing your tax code. Your bank will give the HMRC the information they need in order to do this.

Need help with Personal Tax Allowances?

We offer a full tax return service for individuals and business where we calculate your tax liability so you can make the appropriate payments to the HMRC. For further information on a range of important dates, take a look at our Tax Calendar.

Simply get in touch now by calling us on 01823 325610 or emailing us at more@handhaccountants.com.